Q&A regarding ATO Notice – Australian Residential Property Foreign Investment Fact Sheet

Q&A regarding ATO Notice – Australian Residential Property Foreign

Investment Fact Sheet

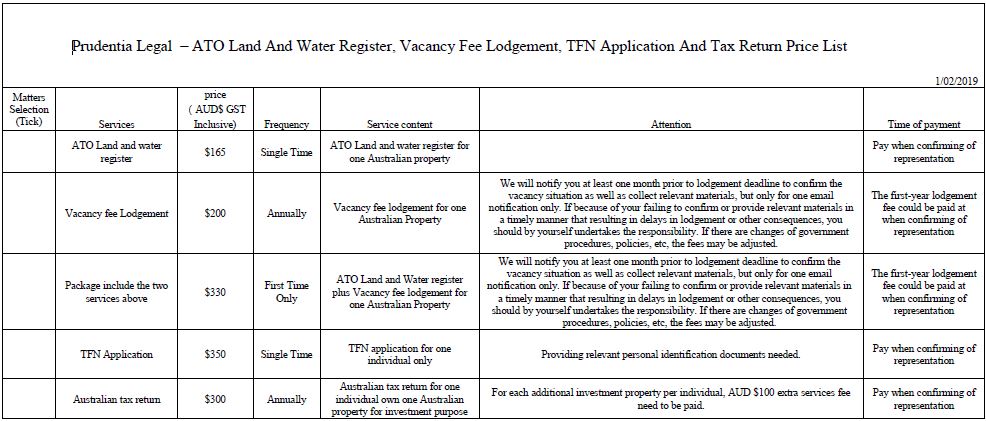

We have received numerous enquiries regarding the Commonwealth Annual Vacancy Fee in relation to our notice sent via email and WeChat weeks ago. We may not able to answer each enquiry one by one due to the limits of time and energy. To your convenience, we have summarized and prepared the following FAQs to help understand the concept. In the meantime, we are now providing the service to register on ATO and lodge Commonwealth Vacancy Fee return on your behalf. In addition, we are also providing the service of Australian Tax File Number application and annual tax return. We will offer our clients a very discounted price for the above services and such offer will keep open until one month from the date of this email.

Please refer to the attached VIP discounted price list and you may also talk to our staff for more details.

Q: What is Commonwealth Annual Vacancy Fee (AVF)?

A: The Commonwealth Annual Vacancy Fee is introduced by the Australian Government for foreign owners, as defined by Foreign Acquisitions and Takeovers Act 1975 of residential dwellings. Under the legislation, foreign owners of residential dwellings in Australian are required to pay an annual vacancy fee if their dwelling is not residentially occupied or rented out for more than six months (183 days) in a year. The reason why we named it as “Commonwealth” AVF is to distinguish from the similar tax/fee applied in the State of Victoria.

A dwelling is considered residentially occupied if the owner or a relative of the owner genuinely occupied the dwelling as a residence, or the dwelling was genuinely occupied as a residence subject to lease or license for minimum terms of 30 days.

The vacancy fee will be the same amount as the foreign investment application fee you paid at the time you submitted your foreign investment application. At current stage, the FIRB application fee is $5,600 for price of the acquisition is $1 million or less, $11,300 for price of the acquisition is more than $1 million and less than $2 million and it will usually will increase for each $1 million increase on the price of acquisition.

Q:Do I need to notice ATO after settlement?

A: Foreign purchasers usually need to notify ATO or register at ATO Land Register as required by the FIRB approval within 30 days after settlement. If the FIRB approval is dated quite early or it’s a preapproval obtained by vendor for the whole development, then there will be no such notice or register requirement on the purchaser. However, ATO still highly recommends such foreign purchasers to notice or register on ATO and it will provide a courtesy reminder of the purchaser’s obligation to complete a vacancy fee return (if applicable).

Q: Do I need to claim Commonwealth Annual Vacancy Return?

A: Foreign purchasers (ie, who has no Australian status) need to claim vacancy fee return. The vacancy fee return must be lodged by foreign owners of residential dwellings who made a foreign investment application for residential property after 9 May 2017 or purchased under a New Dwelling Exemption Certificate that a developed applied for after 9 May 2017. Foreign owners need to lodge the vacancy fee return for previous year within 30 days from the end of each vacancy year.

That means, if the above requirement is satisfied, you will need to lodge the vacancy fee return annually even if the property is not vacant or the vacancy fee is not necessary. It is similar like lodging personal income tax return in Australia each year, where it will depending upon the person who needs to lodge the tax return no matter any tax is payable or not.

Q: Do I still need to pay the Annual Vacancy Fee or register with ATO if I have rented my property out?

A:If the property is residentially occupied or rented out for more than six months (183 days) in a year, you don’t need to pay the federal vacancy fee. However, if the FIRB application date is after 9 May 2017, you may still need to lodge the vacancy fee return each year. If the FIRB application date is before 9 May 2017, then the vacancy rule will not apply and thus you don’t need to lodge the return each year or pay the vacancy fee. Whether you need to notice or register with ATO will depend on the contents of the FIRB approval. Even if there is no such requirement, ATO still highly recommends such foreign purchasers to notice or register on ATO and it will provide a courtesy reminder of the purchaser’s obligation to complete a vacancy fee return (if applicable).

Q: Do I need to pay the Commonwealth Annual Vacancy Fee if I have rented my property to a company which rented the property for short term lease, such as Airbnb?

A: First, the Commonwealth Vacancy Fee rule only applies to foreign owners who made a FIRB application for the residential property after 9 May 2017. If this is satisfied and the company is renting out the property for short term lease of lease than 30 days, the vacancy fee may apply. Alternatively speaking, if there is no any lease more than 30 days and the total lease term is more than 6 months (183 days) during a year, then the vacancy fee may apply for this vacancy year.

Q:Do I need to pay the Commonwealth Annual Vacancy Fee if I have rented my property for short term lease on Airbnb?

A: Please refer to the previous question.

Q: Do I have to pay the vacancy fee if my children/child or a distant relative live(s) in the property?

A: As stated above, a dwelling is considered residentially occupied if the owner or a relative of the owner genuinely occupied the dwelling as a residence. A relative of a member means any of the following: a parent, grandparent, brother, sister, uncle, aunt, nephew, and niece, lineal descendant or adopted child of the member or their spouse, and a spouse of any individual specified above.

Q:Do I need to pay the Commonwealth Annual Vacancy Fee if I have purchased a vacant land but has not started any construction yet?

A: First it will depend on the FIRB application date when purchased land. If the FIRB application date is after 9 May 2017, you need to notify ATO and lodge the vacancy fee return. However, you don’t have to lodge a vacancy fee return a dwelling has been constructed on the land.

Q:Do I need to register or pay the Commonwealth Annual Vacancy Fee if I have purchased the property in 2016, but it is settled in 2018?

A: It also depends on the FIRB application date and if the property has met the residentially occupied requirements each year. Please refer to the previous questions for more details.

Q:Do I still need to register with ATO if I don’t need to pay the Federal Annual Vacancy Fee? If after I register and I have rented out my property, do I still need to notice ATO each year?

A: First, whether you need to register with ATO after settlement depends on whether there is such requirement in your FIRB approval. Even if there is no such requirement, ATO still highly recommends to do so. If the FIRB approval application date is after 9 May 2017, you need to lodge the vacancy fee return each year even if you don’t need to actually pay the vacancy fee. For example, when you have rented out your property each year for not short term lease.

Q: What is the vacancy year?

A: As stated above, foreign residential dwelling owners must lodge the vacancy fee return with ATO within 30 days of the end of each vacancy year. A vacancy is each successive period of 12 months starting on the occupation day for the dwelling during which you have continuously held an interest in the dwelling. The occupation day is the first day you have the right to occupy the dwelling. This will typically be the settlement day.

Q: VIC Vacant Residential Land Tax?

A: In addition to the above Commonwealth Annual Vacancy Fee, from 1 January 2018, a vacant residential land tax applies to homes in inner and middle Melbourne that were vacant for more than six months in the preceding calendar year. The concept is similar to the above vacancy fee and is assessed by calendar year (1 January to 31 December).

This annual tax is set at 1% of the capital improved value (CIV) of taxable land. For example, if a vacant home has a CIV of $500,000, the tax will be $5,000.

For any properties satisfy the requirements of VIC Vacant Residential Land Tax, the property owner is required to notify the VIC state revenue office about the property by 15 January of the following year using the office’s online portal.

Q: Do I still need to pay for the vacancy fee or vacancy residential land tax if I am Australian citizen or PR?

A: Simply speaking, Australian Citizen or PR does not need to apply for FIRB when they purchase the property and the federal vacancy fee only applies to foreign residential property owners. Thus, the federal vacancy fee will not apply to Australian Citizen or PR.

However, VIC Vacant Residential Land Tax as mentioned above will apply to all purchasers regardless they are Australian residents or not.

Q: Where can I find my FIRB approval?

A:If you have engaged us, Prudentia Legal, as your solicitor for your purchase matter, we would have, complying with and FIRB requirements, applied FIRB approval for any foreign purchaser if the development or project does not have FIRB preapproval (Exemption Certificate). We will email you the FIRB approval after we have obtained that.

If you are client of Prudentia Legal, please seek or search our email correspondences to you for the FIRB approval. You can try to search ‘FIRB’ in your emails. If you cannot find it, please email us with your full name, property address you have purchased, the lot number and our file number and we then can forward you the FIRB approval again.

Q: If I am going to sell the property, or if I have obtained Australian PR or Australian Citizen Status, do I still need to lodge vacancy fee return?

A: If the property is sold or otherwise legally transferred during a vacancy year, or the owner is no longer a foreign person, a vacancy fee return will not be required to be lodged. However, the owner may still need to notice ATO in order to update their records and remove or end the owner’s vacancy fee obligation. There are different ways to notice ATO including lodge a form via the ATO Land Register, lodge a vacancy fee return or email ATO to illustrate the situation. We are happy to communicate with ATO on your behalf. Please contact our staff for details and fees. You may also refer to the price list in the attachment.

Q: I have terminated purchase or cannot settle at last. Do I still need to notice ATO?

A: if you have engaged us to formally terminate your purchase or cannot settlement for any reason, you do not need to notice ATO in relation to this matter.

Q: Do I have to notice, register on ATO and also claim relevant vacancy fee by myself, or can I engage lawyer to do this on my behalf?

A: Strictly speaking, foreign purchasers have to register the property purchaser on the ATO Land Register no later than 30 days after settlement, or notice ATO. The register, notice including the vacancy fee or vacant land tax return (whether Federal or VIC) report or notice are all the procedures after settlement. Therefore, it is not part of the purchase procedure and also beyond our property purchase engagement scope. It should be the owner’s obligation to make relevant register or notice by himself/herself. Because the condition or situation of the property may change each year, the property owner who has satisfied the above conditions needs to lodge a vacancy fee return each year. If you want to engage us specifically for the register, notice or the lodge vacancy fee return issue, we may need you to sign a new engagement or costs agreement and relevant legal fees will apply. Please contact our staff for further details.

Q: Where can I find any information for the vacancy fee?

A: You can obtain more information from the ATO website regarding the vacancy fee. Please refer to: ato.gov.au/vacancyfee

The above FAQ is based on the common questions we have collected from our clients and for your convenience. We may not able to answer each question from you regarding the vacancy fee. If you need more information or more consultant, we may charge legal fees based on the work.

Please note:The contents of our publications are intented for general information purpose only, and should not be construed as legal advice on any matter. The constent is subject to change without notice.

No person may rely on any information contained in this website.

The contents cannot be quoted or referred to in any other publication or proceeding without the prior written consent of Prudentia Legal Pty Ltd, to be given or withheld at our discretion.

相关内容

-

详情

详情How to make payments to Prudentia Legal

How to make payments to Prudentia Legal

-

详情

详情Q & A:Do I have to pay the vacancy fee if my children/child or a distant relative live(s) in the ...

A:As stated above, a dwelling is considered residentially occupied if the owner or a relative of the owner genuinely occupied the dwelling as a residence. A relative of a member means any of the following: a parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descendant or adop

-

详情

详情Q& A: Do I need to pay the Commonwealth Annual Vacancy Fee if I have rented my property t...

A: First, the Commonwealth Vacancy Fee rule only applies to foreign owners who made a FIRB application for the residential property after 9 May 2017. If this is satisfied and the company is renting out the property for short term lease of lease than 30 days, the vacancy fee may apply. Alternatively

-

详情

详情Q & A: Do I still need to pay the Annual Vacancy Fee or register with ATO if I have rented my...

A: If the property is residentially occupied or rented out for more than six months (183 days) in a year, you don’t need to pay the federal vacancy fee. However, if the FIRB application date is after 9 May 2017, you may still need to lodge the vacancy fee return each year. If the FIRB application d

-

详情

详情Q & A: Do I need to claim Commonwealth Annual Vacancy Return?

A:Foreign purchasers (ie, who has no Australian status) need to claim vacancy fee return. The vacancy fee return must be lodged by foreign owners of residential dwellings who made a foreign investment application for residential propertyafter 9 May 2017or purchased under a Ne

-

详情

详情Q & A : Do I need to notice ATO after settlement?

A:Foreign purchasers (ie, who has no Australian status) need to claim vacancy fee return. The vacancy fee return must be lodged by foreign owners of residential dwellings who made a foreign investment application for residential propertyafter 9 May 2017or purchased under a New Dwel

-

详情

详情Q & A :What is Commonwealth Annual Vacancy Fee (AVF)?

A: The Commonwealth Annual Vacancy Fee is introduced by the Australian Government for foreign owners, as defined byForeign Acquisitions and Takeovers Act 1975of residential dwellings. Under the legislation, foreign owners of residential dwellings in Australian are required to pay an annu

-

详情

详情Q&A regarding ATO Notice – Australian Residential Property Foreign Investment Fact Sheet

Q&A regarding ATO Notice – Australian Residential Property ForeignInvestment Fact SheetWe have received numerous enquiries regarding the Commonwealth Annual Vacancy Fee in relation to our notice sent via email and WeChat weeks ago. We may not able to answer each enquiry one by one due to